Hi folks,

I'm brand new to Motivewave and just conducting the trial (version 6.7.10)

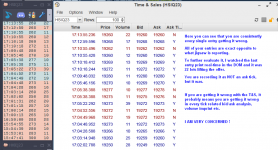

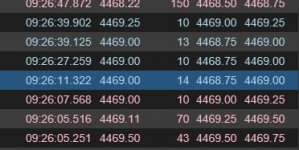

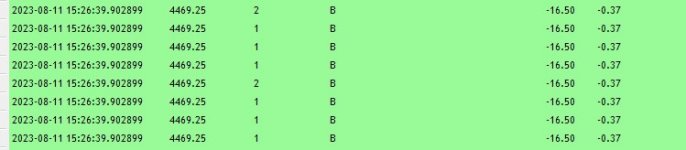

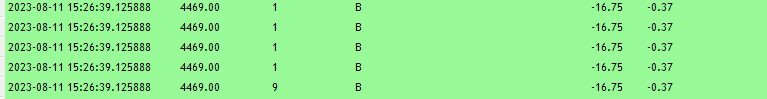

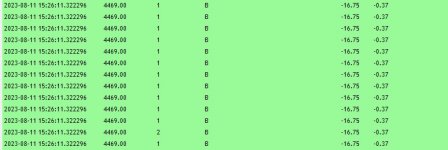

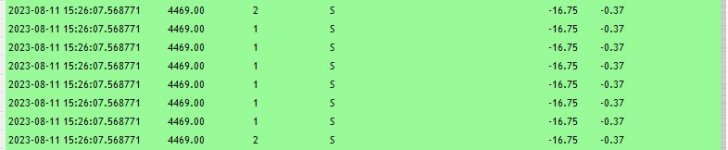

Attached here is a screenshot of a T&S screen from Motivewave compared to Jigsaw trading. Both platforms are using the exact same data feed (CQG) and both platforms were being watched in real-time when I recorded this screenshot. Both T&S are filtering 10 + lots only. You can see that their timestamps and sizes sync up perfectly but their action of trading on the bid or the ask are completely opposite. The very top print being compared I watched in real-time as the 22 lots was lifted on the offer yet MW has assigned it as not an ask tick (which it was) and will show in the T&S that it was no the bid (which it was not). Having watched this in real-time, I conclude that every single entry in that T&S screenshot is assigned wrong and that is why it is 100% opposite to Jigsaw.

I may be new to Motivewave but I'm not new to trading. Suffice it to say that I am extremely alarmed to find this. If the T&S is wrong then there is high potential that all volume related bid/ask analysis within MW is going to be wrong. I'm actually a bit scared to proceed with this free trial as already it seems like this platform evaluation could be a waste of time.

Anyone should be able to check this on their own feeds and products by setting a high enough volume filter so can easily see it trade in real-time compared with the DOM recent trades columns. I'd appreciate anyone else assessing this on their own configuration chiming in.

With kind regards,

MK

I'm brand new to Motivewave and just conducting the trial (version 6.7.10)

Attached here is a screenshot of a T&S screen from Motivewave compared to Jigsaw trading. Both platforms are using the exact same data feed (CQG) and both platforms were being watched in real-time when I recorded this screenshot. Both T&S are filtering 10 + lots only. You can see that their timestamps and sizes sync up perfectly but their action of trading on the bid or the ask are completely opposite. The very top print being compared I watched in real-time as the 22 lots was lifted on the offer yet MW has assigned it as not an ask tick (which it was) and will show in the T&S that it was no the bid (which it was not). Having watched this in real-time, I conclude that every single entry in that T&S screenshot is assigned wrong and that is why it is 100% opposite to Jigsaw.

I may be new to Motivewave but I'm not new to trading. Suffice it to say that I am extremely alarmed to find this. If the T&S is wrong then there is high potential that all volume related bid/ask analysis within MW is going to be wrong. I'm actually a bit scared to proceed with this free trial as already it seems like this platform evaluation could be a waste of time.

Anyone should be able to check this on their own feeds and products by setting a high enough volume filter so can easily see it trade in real-time compared with the DOM recent trades columns. I'd appreciate anyone else assessing this on their own configuration chiming in.

With kind regards,

MK