Blonde

Well-known member

- Joined

- Jun 3, 2021

- Posts

- 52

- Likes

- 0

Hiya,

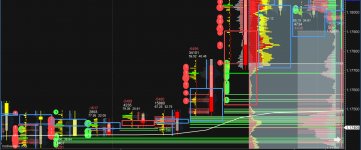

There are many Order Flow Analysis tools in the market and there are few tools in Motivewave Ultimate as a native set for analysis. I found this Order Flow Analysis but I don't know if it's accurate and worth purchasing or not:

AlgoX Upgrade for MotiveWave,

Lifetime license upgrade for adding AlgoX to OFA for MotiveWave

$750.00

+

OFA for MotiveWave (one-time)

$499.00

=

Total: 1,249.00 USD

How can I be sure that there will not be any hidden fee or update, upgrade, support fee extra in the next 10 years for these?

What else add-on's do you suggest for Order-Flow Analysis and Volume? or any generic Add-on's, please?

Are these worth purchasing, please? And how can I find out that these indicators coded professionally and their mathematical analysis and programming architecture and development procedure are accurate and lead to accurate measurements of the market, please?

Tnx and best of luck

There are many Order Flow Analysis tools in the market and there are few tools in Motivewave Ultimate as a native set for analysis. I found this Order Flow Analysis but I don't know if it's accurate and worth purchasing or not:

AlgoX Upgrade for MotiveWave,

Lifetime license upgrade for adding AlgoX to OFA for MotiveWave

$750.00

+

OFA for MotiveWave (one-time)

$499.00

=

Total: 1,249.00 USD

How can I be sure that there will not be any hidden fee or update, upgrade, support fee extra in the next 10 years for these?

What else add-on's do you suggest for Order-Flow Analysis and Volume? or any generic Add-on's, please?

Are these worth purchasing, please? And how can I find out that these indicators coded professionally and their mathematical analysis and programming architecture and development procedure are accurate and lead to accurate measurements of the market, please?

Tnx and best of luck