Has anyone made a version of this for the MotiveWave software?

The source code is attached below - the below was done for the TradingView platform:

//@version=4

//

// Copyright (C) 2017 CC BY, whentotrade / Lars von Thienen

// Source:

// Book: Decoding The Hidden Market Rhythm - Part 1: Dynamic Cycles (2017)

// Chapter 4: "Fine-tuning technical indicators for more details on the cRSI Indicator

//

// Usage:

// You need to derive the dominant cycle as input parameter for the cycle length as described in chapter 4.

//

// License:

// This work is licensed under a Creative Commons Attribution 4.0 International License.

// You are free to share the material in any medium or format and remix, transform, and build upon the material for any purpose,

// even commercially. You must give appropriate credit to the authors book and website, provide a link to the license, and indicate

// if changes were made. You may do so in any reasonable manner, but not in any way that suggests the licensor endorses you or your use.

//

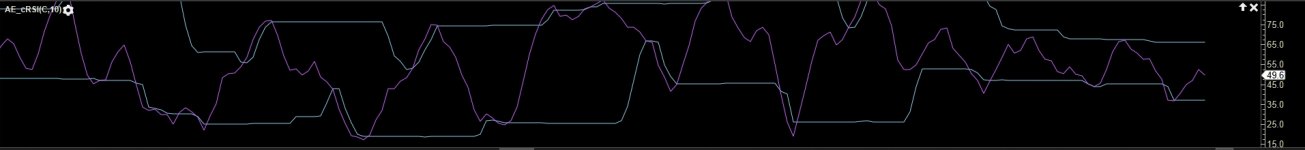

study(title="RSI cyclic smoothed", shorttitle="cRSI")

src = close

domcycle = input(20, minval=10, title="Dominant Cycle Length")

crsi = 0.0

cyclelen = domcycle / 2

vibration = 10

leveling = 10.0

cyclicmemory = domcycle * 2

//set min/max ranges?

h1 = hline(30, color=color.silver, linestyle=hline.style_dashed)

h2 = hline(70, color=color.silver, linestyle=hline.style_dashed)

torque = 2.0 / (vibration + 1)

phasingLag = (vibration - 1) / 2.0

up = rma(max(change(src), 0), cyclelen)

down = rma(-min(change(src), 0), cyclelen)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - 100 / (1 + up / down)

crsi := torque * (2 * rsi - rsi[phasingLag]) + (1 - torque) * nz(crsi[1])

lmax = -999999.0

lmin = 999999.0

for i = 0 to cyclicmemory - 1 by 1

if nz(crsi, -999999.0) > lmax

lmax := nz(crsi)

lmax

else

if nz(crsi, 999999.0) < lmin

lmin := nz(crsi)

lmin

mstep = (lmax - lmin) / 100

aperc = leveling / 100

db = 0.0

for steps = 0 to 100 by 1

testvalue = lmin + mstep * steps

above = 0

below = 0

for m = 0 to cyclicmemory - 1 by 1

below := below + iff(crsi[m] < testvalue, 1, 0)

below

ratio = below / cyclicmemory

if ratio >= aperc

db := testvalue

break

else

continue

ub = 0.0

for steps = 0 to 100 by 1

testvalue = lmax - mstep * steps

above = 0

for m = 0 to cyclicmemory - 1 by 1

above := above + iff(crsi[m] >= testvalue, 1, 0)

above

ratio = above / cyclicmemory

if ratio >= aperc

ub := testvalue

break

else

continue

lowband = plot(db, "LowBand", color.aqua)

highband = plot(ub, "HighBand", color.aqua)

fill(h1, h2, color=color.silver, transp=90)

fill(lowband, highband, color=color.gray, transp=90)

plot(crsi, "CRSI", color.fuchsia)

The source code is attached below - the below was done for the TradingView platform:

//@version=4

//

// Copyright (C) 2017 CC BY, whentotrade / Lars von Thienen

// Source:

// Book: Decoding The Hidden Market Rhythm - Part 1: Dynamic Cycles (2017)

// Chapter 4: "Fine-tuning technical indicators for more details on the cRSI Indicator

//

// Usage:

// You need to derive the dominant cycle as input parameter for the cycle length as described in chapter 4.

//

// License:

// This work is licensed under a Creative Commons Attribution 4.0 International License.

// You are free to share the material in any medium or format and remix, transform, and build upon the material for any purpose,

// even commercially. You must give appropriate credit to the authors book and website, provide a link to the license, and indicate

// if changes were made. You may do so in any reasonable manner, but not in any way that suggests the licensor endorses you or your use.

//

study(title="RSI cyclic smoothed", shorttitle="cRSI")

src = close

domcycle = input(20, minval=10, title="Dominant Cycle Length")

crsi = 0.0

cyclelen = domcycle / 2

vibration = 10

leveling = 10.0

cyclicmemory = domcycle * 2

//set min/max ranges?

h1 = hline(30, color=color.silver, linestyle=hline.style_dashed)

h2 = hline(70, color=color.silver, linestyle=hline.style_dashed)

torque = 2.0 / (vibration + 1)

phasingLag = (vibration - 1) / 2.0

up = rma(max(change(src), 0), cyclelen)

down = rma(-min(change(src), 0), cyclelen)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - 100 / (1 + up / down)

crsi := torque * (2 * rsi - rsi[phasingLag]) + (1 - torque) * nz(crsi[1])

lmax = -999999.0

lmin = 999999.0

for i = 0 to cyclicmemory - 1 by 1

if nz(crsi, -999999.0) > lmax

lmax := nz(crsi)

lmax

else

if nz(crsi, 999999.0) < lmin

lmin := nz(crsi)

lmin

mstep = (lmax - lmin) / 100

aperc = leveling / 100

db = 0.0

for steps = 0 to 100 by 1

testvalue = lmin + mstep * steps

above = 0

below = 0

for m = 0 to cyclicmemory - 1 by 1

below := below + iff(crsi[m] < testvalue, 1, 0)

below

ratio = below / cyclicmemory

if ratio >= aperc

db := testvalue

break

else

continue

ub = 0.0

for steps = 0 to 100 by 1

testvalue = lmax - mstep * steps

above = 0

for m = 0 to cyclicmemory - 1 by 1

above := above + iff(crsi[m] >= testvalue, 1, 0)

above

ratio = above / cyclicmemory

if ratio >= aperc

ub := testvalue

break

else

continue

lowband = plot(db, "LowBand", color.aqua)

highband = plot(ub, "HighBand", color.aqua)

fill(h1, h2, color=color.silver, transp=90)

fill(lowband, highband, color=color.gray, transp=90)

plot(crsi, "CRSI", color.fuchsia)